Latest Updates

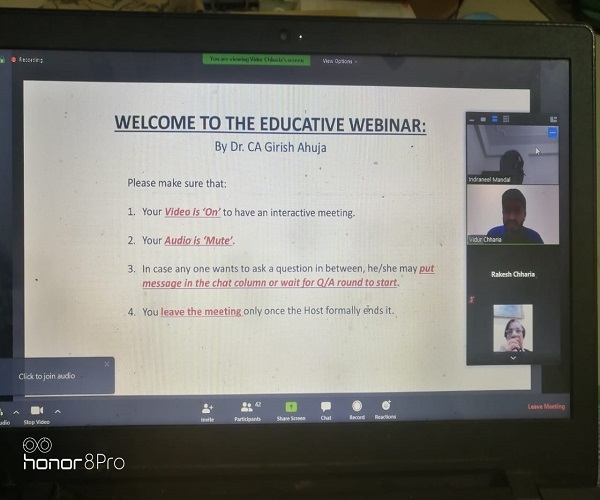

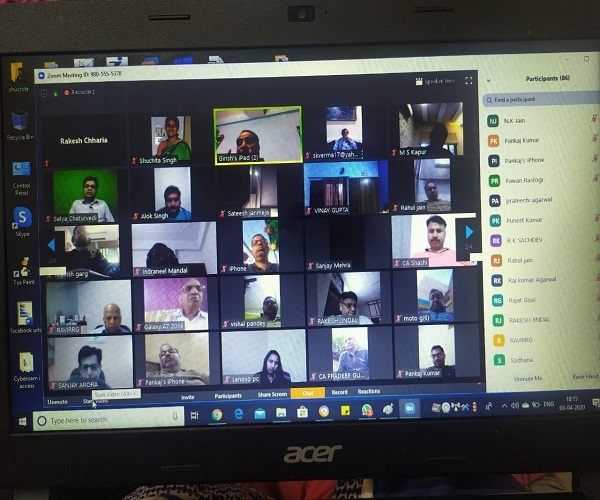

Faculty at I.T.S Ghaziabad attended a webinar by Dr. CA Girish Ahuja hosted by GMA on 3.4.2020 at 6:00 pm

Major points discussed during the session were regarding filling the Income Tax and GST. the points can be summed up as below

- Date for filing Income Tax Return has been extended upto 30.6.2020

- Linking of Aadhar to avail benefits has been extended upto 30.6.2020

- Date of application and payment for VIVAD SE VISHWAS scheme has also been extended upto 30.6.2020

- Last date for filing STT, CTT, equalization has been extended upto 30.6.2020

- Timelies of taking deductions u/s 80C, 80D, 80E, donations u/s 80G, 80GGP, 80GGC has been extended upto 30.6.2020

- Contribution in PM Care Scheme is subject to 100% deductions, if contributed upto 30.6.2020

- For SEZ, u/s 10AA, approval for production can be taken upto 30.6.2020

- Rollover benefits for Capital Gains u/s 54, 54 B, 54 E/F/G/GA and GB can be taken up to 30.6.2020

- for SME having production less than 5 cr can fill form GSTR 3B upto 30.6.2020, without any interest charges

- for SME having production more than 5 cr will get extension for 15 days after the due date and after extension period 9% interest will be charged

- benefits of composition scheme can be availed upto 30.6.2020

At the end participants raised questions with the resource person